In a major boost for aspiring homeowners in Queensland, the Palaszczuk Government made a ground-breaking announcement on Sunday, 19 November 2023. The much-celebrated news revealed that the First Homeowner Grant would be doubled to an impressive $30,000. This significant change came into effect immediately on Monday, 20 November, and will remain in place until 20 June 2025.

Let’s delve into the details of this exciting development and what it means for first home buyers in the Sunshine State.

Read More About the Grant Here and we will keep you updated as information comes to hand.

Qualification Criteria:

To take advantage of this increased grant, there are specific criteria that aspiring homeowners must meet.

🏡 About the Dwelling

The property must be a new (and not previously lived in) home 🆕

The value of the property must be less than $750,000 💰

Eligible properties include new homes, units, townhouses, duplex, or granny flats. 🏘️

About You:

The applicant must be 18 years or older 🙌🏻

This must be the first residential property owned in Australia by the applicant 🥇

Read more qualifying criteria here

The Extended Opportunity:

This enhanced First Homeowner Grant is not only a financial incentive but also a catalyst for the Queensland property market. With the extended timeframe until 20 June 2025, first home buyers have a unique opportunity to explore the market, secure their dream homes, and make the most of the doubled grant.

Benefits for Aspiring Homeowners:

The doubled grant provides substantial financial relief for those embarking on their first home buying journey. It serves as a powerful tool to mitigate the challenges associated with entering the property market, making homeownership more accessible and achievable for many Queensland residents.

If you’re considering taking advantage of this fantastic opportunity, now is the time to contact Go Mortgage. We can be your partner in this financial journey and find you the best deal! Go Mortgage offers the tools and support throughout your journey to getting into your home.

Financial Assessment

This is where we will look at your unique situation and help you understand how much you can afford to borrow and what your budget allows for.

We also look at ALL the incentives you qualify for as a First Home buyer and help you collect as much as possible. Do you qualify for:

– The First Homeowners Grant = $30K cash FHOG

– The First Home Buyer Guarantee Scheme = No LMI with FHBG

– The Stamp Duty Concession = Pay no Stamp duty

– The First Home Super Saver Scheme = Use your Super

Access to Multiple Lenders

We have access to a wide network of lenders, including major banks, credit unions, and other financial institutions. This allows us to ‘shop’ around for the best mortgage rates and terms tailored to you.

Loan Comparison

We will compare different loan products from the various lenders and present you with a clear understanding of the options available. This includes fixed-rate mortgages, variable-rate mortgages, and other specialised products.

Guidance Through the Application Process

This can be very complex, but we do it every day! We can navigate the mortgage application process for you, guiding you through each step, ensuring that all necessary documentation is prepared and submitted correctly. This can save a lot of time and potential heartache for you.

Negotiation on Your Behalf

Go Mortgage will negotiate with lenders on your behalf, seeking favourable terms, lower interest rates, or other concessions that may benefit you.

Understanding Loan Types

We will explain the different types of loans available, and help you choose the one that aligns with your financial goals.

Pre-Approval Assistance

Getting pre-approved for a mortgage is a crucial step in the home-buying process. We will get this for you, and it will arm you with the right information to find a property that is achievable for you, without wasting precious time looking at a location or a budget that may not be realistic.

Explanation of Fees and Charges

Go Mortgage will break down the various fees and charges associated with obtaining a mortgage and make sure you understand the financial implications of your loan.

Ongoing Support

We are with you from go to whoa 😉! Another resource that you will find handy is our First Home Buyer Handbook. Download it from the website today.

Go Mortgage will provide ongoing support, answer questions, address concerns, and help you navigate any challenges that may arise along the way and then into the future.

In summary, Go Mortgage is your partner in your financial journey and will be your knowledgeable guide throughout the home-buying process to ensure you have made an informed decisions that align with your financial goals.

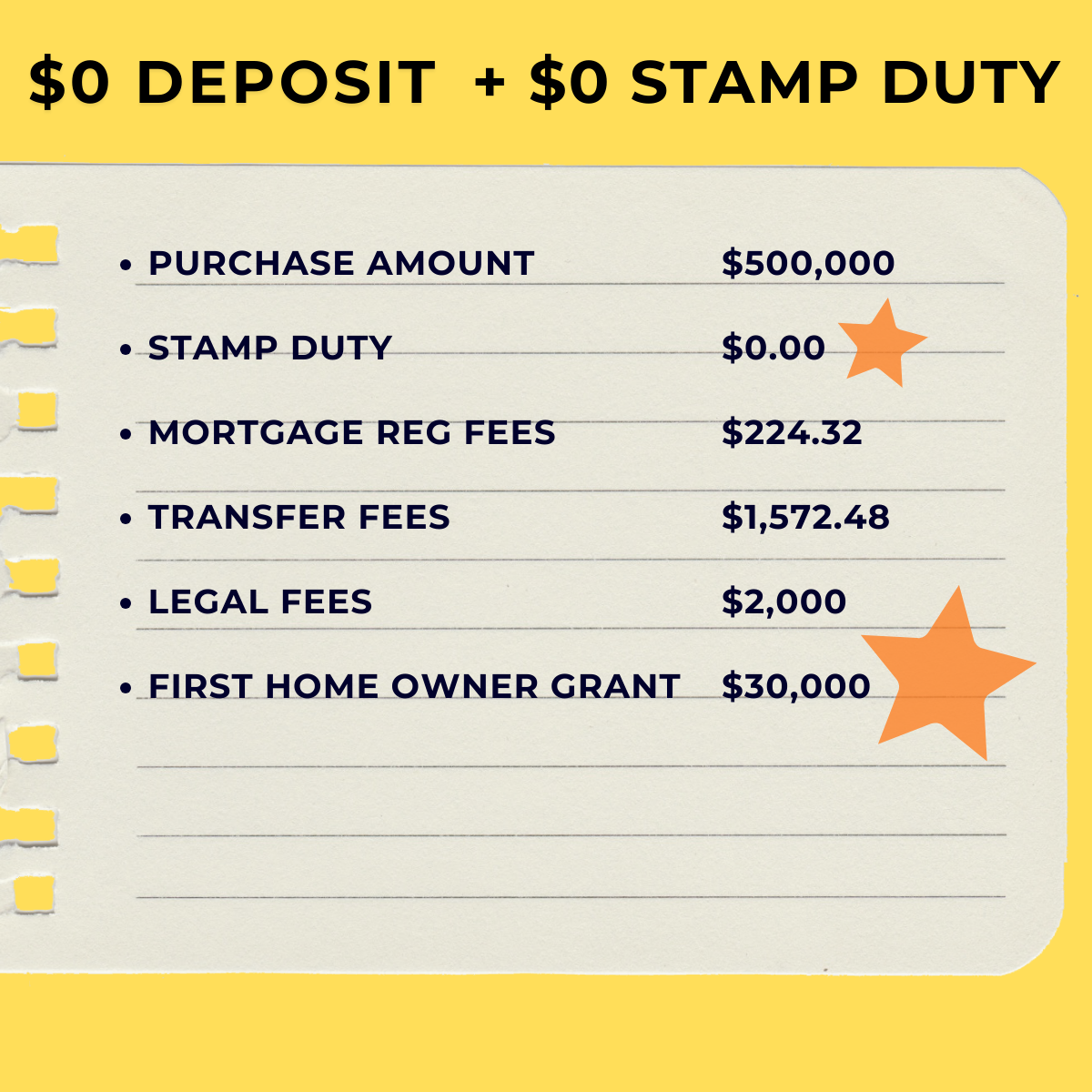

Below are some examples that may be useful to you when looking at different property prices and your savings.

Scenario 1:

Scenario 2:

If you would like to read more of the talk around the grants, read the Urban Developer Article here.

Read previous Go Mortgage blog on the First Home Buyer Scheme

Read the Queensland Government media statement Here