Learn about one of the most basic details of your home loan and how to make use of it to pay your loan off quicker.

The phrase “principal and interest” or “P&I” is top of mind for many borrowers at the moment.

Recent moves by the Australian Prudential Regulation Authority (APRA) have seen many lenders cut rates on principal and interest home loans while raising rates for interest-only borrowers. These rate moves have grabbed media attention, as lenders try to incentivise interest-only borrowers to move to principal and interest repayments.

If all that media coverage has you scratching your head, fear not: We’re here to demystify principal and interest repayments for you.

Put simply, a principal and interest payment means your repayment is divided up into two portions. Some is sent towards paying off the interest due on your outstanding loan amount, while the remainder goes towards paying off the outstanding loan amount itself.

What does principal and interest mean?

Principal is how much money you borrowed from the bank.

Interest is the extra money you have to pay back for borrowing that money.

Why can the amounts of interest and principal I pay change over the course of my loan?

If you take out a loan in which repayments go towards both the interest and principal payments, you’ll notice most of your repayment will go towards interest at the beginning of the loan and only a small amount will go towards the principal.

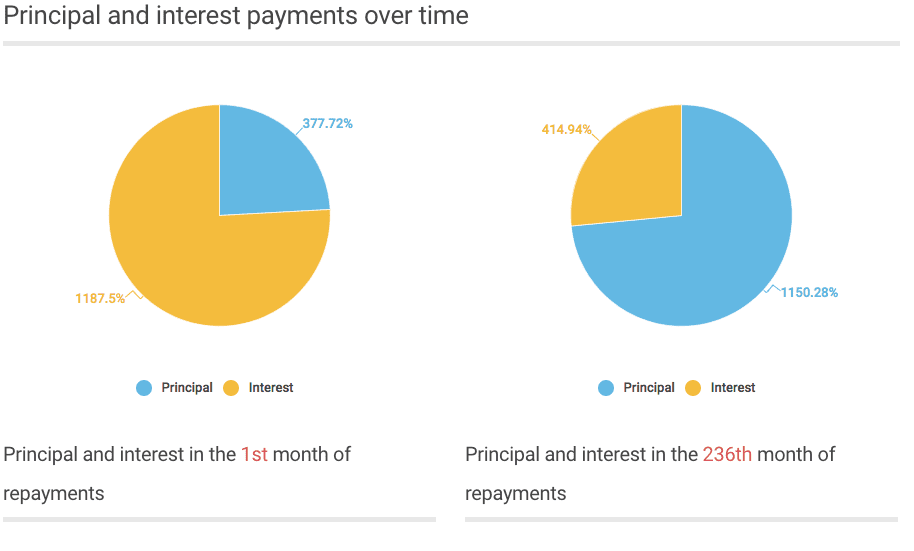

Look at the two graphs below, based on a $250,000 loan at 5.70% p.a. over 25 years.

In the first month of repayments you’re paying interest on the whole amount you’ve borrowed, but as this amount is paid off over the years, the interest due is smaller.

But if you’re paying less interest and the principal is getting smaller, why are your repayments not getting smaller?

This is because your lender has worked out exactly how much you’ll need to spend on each repayment to pay off your loan in the term you’ve agreed to. The result of these calculations is called an amortisation schedule. The schedule shows how much of your payments go towards interest and how much goes towards principal payments and this will show that the amount that goes towards paying off the principal gets bigger as the years go on and does so at a faster rate.

If you want to talk more about your loan and how to make it work better for you CALL US or EMAIL US now.