You have probably heard the word ‘equity’ thrown around in financial conversations. While those with a banking background may find this an easy concept to grasp, it can raise question marks for buyers new to the housing market, or anyone unfamiliar with financial jargon. Let’s try and answer a few of those questions for you!

You have probably heard the word ‘equity’ thrown around in financial conversations. While those with a banking background may find this an easy concept to grasp, it can raise question marks for buyers new to the housing market, or anyone unfamiliar with financial jargon. Let’s try and answer a few of those questions for you!

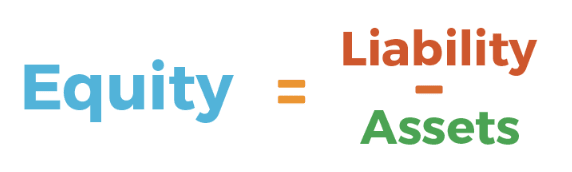

So, what exactly does equity mean?

In the context of home loans, equity refers to the difference between what your property is worth and how much you owe on it. For example, if your house is valued at $600k and you have a $400k loan, you have $200k in equity.

Your equity can change based on a number of variables. If the value of your property goes up or the principle on your mortgage comes down, your equity increases. If the property market crashes, or you fall behind on your mortgage repayments, your equity may decrease.

How can I increase my equity?

Paying off your mortgage is the best way to increase your equity. Extra lump sum repayments, or periodic payments that exceed the minimum requirements are great ways to quickly reduce the principle.

Renovating your house can also be a good way of adding value. A kitchen refresh or functional timber decking area can be attractive ways to add value to your home and thus increase your equity.

How can I access my equity?

You probably need to find a way to fund those renovations. After all, they say you’ve got to spend money to make money! An easy way to access your equity is by dipping into your “redraw” facility. This means that if you have made extra repayments onto your loan, you can draw these out for expenses.

If your loan does not have a redraw facility, you can also chat to your Go Mortgage Broker about a loan “top up”. This means borrowing additional funds using your existing loan, without having to go through the application process again. This can be a handy option as it saves you time, money and energy.

What can I do with my equity?

The opportunities are endless! Whether you were eyeing that new caravan, dreaming of a family trip to Hamilton Island, or considering a move into the realm of property investment, learning more about your equity is the perfect place to start.