by gomcadmin | Mar 26, 2017 | Go Mortgage Blog

All of the big four banks have announced changes to out-of-cycle interest rates in the last week, as lenders respond to pressure on funding costs and increasing investor appetite. Commonwealth Bank was the last of the big four to announce changes to their...

by gomcadmin | Mar 21, 2017 | Go Mortgage Blog

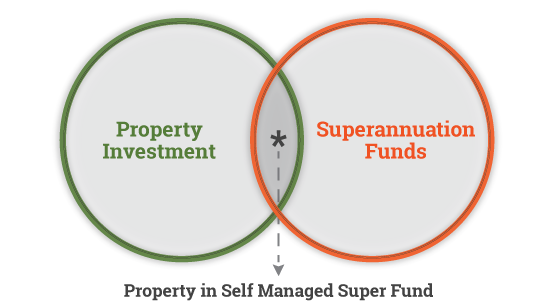

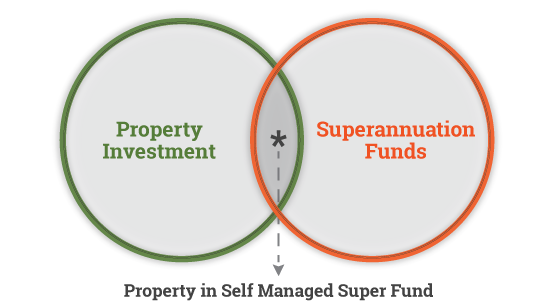

Australia’s appetite for property is showing no signs of abating. And traditionally, Aussies have purchased investment properties personally or through a company/trust. Did you know you can also buy an investment through your self-managed super fund (SMSF) and obtain...

by gomcadmin | Mar 13, 2017 | Go Mortgage Blog

Despite mortgages being the largest financial obligation most Australians will ever have, many are still paying far too much over the life of the loan. But Why? Well it seems it’s not knowledge that most of us struggle with. The real issue is retention &...

by gomcadmin | Mar 9, 2017 | Go Mortgage Blog

When a property investor determines their long-term investment strategy and objectives, the loan structure is an important factor to consider as it can significantly impact the overall success of the investor’s portfolio. Seeking the advice of a credit adviser will...

by gomcadmin | Mar 6, 2017 | Go Mortgage Blog

DAVID Dyball had dreamed of being a homeowner for as long as he could remember but there was one word stopping him: Deposit. The Maryborough man, 28, has purchased a home without a deposit in Aldershot The Fraser Coast Chronicle reports. And he is sharing...

by gomcadmin | Feb 28, 2017 | Go Mortgage Blog

Home loan loyalty is costing Australian mortgage holders a whopping $6 billion a year, according to new research from comparison site Mozo.com.au. Despite a surge in smaller lenders offering mortgage rates under 4.00%, borrowers are wasting $17 million a day by...