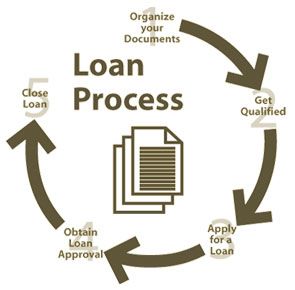

Every person seeking a home loan has to undergo a number of steps from start to settlement. Understanding what happens in each step can help you prepare for the process. Of course we will be there to guide you and make the whole experience as smooth as possible.

Every person seeking a home loan has to undergo a number of steps from start to settlement. Understanding what happens in each step can help you prepare for the process. Of course we will be there to guide you and make the whole experience as smooth as possible.

Step 1: Assessment

During the assessment process your Go Mortgage Broker will discuss and help you select the most appropriate features and home loan rate that best suits your finance needs. To enable this process to take place you will need to complete a Fact Finder Questionnaire for your broker.

Once the right loan is selected, the loan application process begins.

Step 2: Loan Application Process

To help make the home loan application as quick and simple as possible, review the checklist below to find out what documents you may need to have ready to apply for your loan:

§ Passport/Visa/Citizenship Certificate

§ Drivers Licence

§ Marriage Certificate

§ Medicare Card

§ Two most recent payslips

§ Most recent PAYG Summary (Group Certificate)

§ If self-employed, the last two year’s full tax returns (Both personal & Business)

§ Proof of existing rental income

§ Proof of proposed rental income

§ Proof of funds to complete – Cash, Redraw, etc

§ Copy of superannuation statements, share certificates etc.

§ Most recent statement for all credit cards, personal loans, leases etc

§ Copy of contract of sale for property being purchased

Your Go mortgage broker will assist you getting all the necessary documentation for your home loan application, and will lodge the loan application with the selected lender.

Step 3: Loan Assessment

The lender will assess your application to determine whether you meet their credit requirements. This process includes confirmation of your income and employment and a credit reference check. Your supporting documents are also verified at this time.

Step 4: Unconditional (Full) Approval

Once the lender is satisfied he will issue unconditional home loan approval and a formal letter of offer will be issued to your broker. The final loan documentation is then issued for your signing and to be returned to the lender/your broker once completed.

Step 5: Insurance

Home and contents insurance provides cover for a range of events such as theft, storm damage, fire and more. This protects both yourself and the lender against a potentially financially devastating event. Most lender require you to obtain insurance on your property and note their interest in the policy; then they request you prove this has been done with a copy of your ‘Certificate of currency’ from the insurance company

We have a range of offers to help cover your property and your home loan. You may need to start your home loan insurance cover prior to settlement.

Step 6: Loan Settlement

Your solicitor/conveyancer will liaise with the lender to schedule a settlement date if you are purchasing a property.

If you are refinancing at this stage we need to organise a discharge form to be sent to your current lender so they can get all the settlement paperwork ready for the new lender to take over. The new lender will then get in touch with the current lender and they will organise a settlement date.

The first repayment on your loan will usually be required one month after the settlement date.

Step 7: Congratulations, welcome to your new Home Loan.