Tip #1 Refinance to a lower interest rate

Work out what features of your current loan you want to keep, and compare the interest rates on similar loans. If you find a better rate elsewhere, ask your current lender to match it or offer you a cheaper alternative.

Comparison websites can be useful, but they are businesses and may make money through promoted links. They may not cover all your options. See what to keep in mind when using comparison websites.

Switching loans – If you decide to switch to another lender, make sure the benefits outweigh any fees you’ll pay for closing your current loan and applying for another.

SMART 💡 Start your refinance assessment here to see if there is a better deal out there for your mortgage

Tip #2 Consider an offset or multiple offset accounts

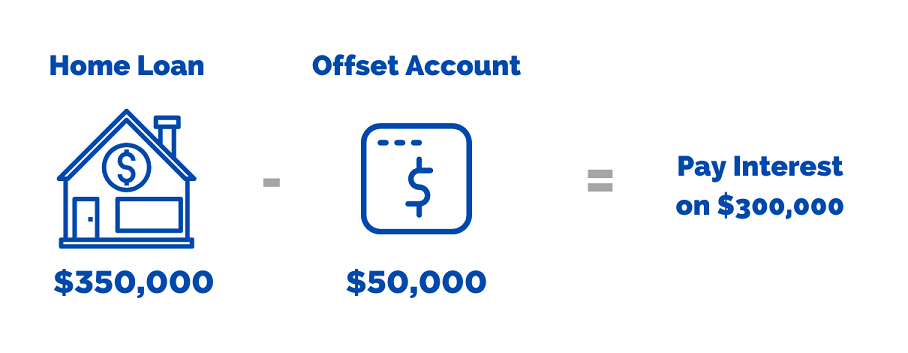

An offset account is a savings or transaction account linked to your mortgage. Your offset account balance reduces the amount you owe on your mortgage. This reduces the amount of interest you pay and helps you pay off your mortgage faster.

For example, for a $350,000 mortgage, $50,000 in an offset account means you’re only charged interest on $300,000. That difference alone can save you ~$1,250 in interest per annum

If your offset balance is always low however (for example under $2,000), it may not be worth having this feature.

SMART 💡 Using multiple offset accounts can enable you to setup a smart budgeting system

Tip # 3 Make extra payments

Extra repayments on your mortgage can cut your loan by years. Putting your tax refund, pay increase or bonus into your mortgage could save you thousands in interest.

On a typical 30 year principal and interest mortgage, most of your payments during the first 8 to 11 years go towards paying off interest. So anything extra you put in during that time will reduce the amount of interest you pay and shorten the life of your loan.

Ask us for a loan that has no fee for making extra repayments.

SMART 💡 Making extra repayments in your offset account will also give you a buffer if interest rates rise in the future.

Tip #4 Your mortgage doesn’t have to suck!

All it takes is a few minutes to reach out to an expert mortgage broker to get the ball

Rolling.. Reviewing or refinancing your Mortgage is not that difficult and can save you thousands.

Let us do the legwork for you… that’s what we do every day and we know where the deals are (and where the pitfalls are too!)

SMART 💡 Call Us now to get the ball rolling